What do consumer demand, stock prices and household balance sheets have in common? Quite a lot, actually - and it may all be tied to Artificial Intelligence. Our North America economist Marcos Carias dives right in.

A good chunk of the resilience in U.S. consumption growth goes hand in hand with the stock market's outperformance.

More so than in any other major developed market, consumption in the U.S. is disproportionately driven by wealthier households. The top 20% account for 40% of consumption, per a U.S. Bureau of Labor Statistics study (other studies have found even steeper inequality).

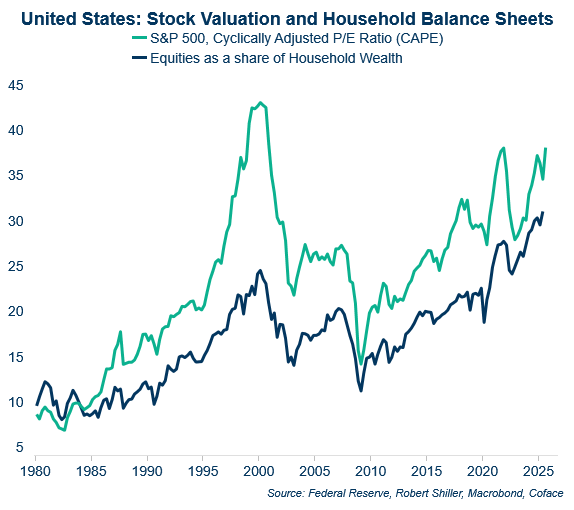

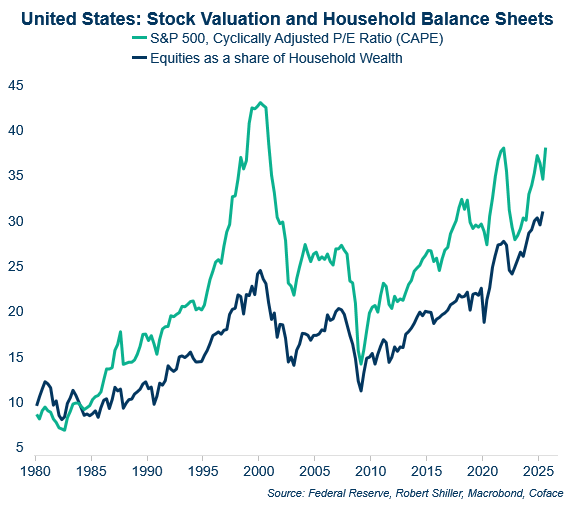

Stock valuations haven't been this high since the eve of the 2022 bear market, and the last time before that was during the dotcom bubble in the early 2000's. Since the launch of ChatGPT in late 2022, AI-related stocks have driven 75% of the S&P 500’s returns.

When the dotcom bubble burst, equities represented 24% of the average American's portfolio. That number has risen to 31%, most of which is owned by the aforementioned top earners.

The CAPE ratio tells you how many times the S&P 500's price is larger than the earnings of the companies therein. It's an indicator of how much investor's faith in future earnings is, relative to their proven capacity to generate earnings. Download graph data here.

As people's wealth builds up, they feel emboldened to spend. If their wealth goes down (and stays down), they start to tighten their belts. These are the feedback loops that make booms amazing, and downturns painful.

The technicalities of whether or not we're in an AI bubble are above my paygrade as a macroeconomist. But, even if we do take the bubble narrative at face value, attempting to time its bursting is a fool's errand.

The parallel to the '08 subprime mortgage crisis is illustrative. Nobel Laureate Robert Shiller was ringing the bell about the real estate bubble as early as 2003. Those who heeded his warning promptly avoided crippling losses, but also left a couple of years worth of exuberant profits on the table. In most cases, those that tried to ride the bubble failed to escape the blast radius in time. Finally, if things get bad enough, expect some sort of response from the Treasury or/and the Fed.

As such, we are sticking to our forecast of slightly-below 2% GDP growth for 2025 and 2026, meaning we're not pricing in a major stock market crash into our baseline scenario. But those exposed to the U.S. economy should keep in mind that some of its key underpinnings are fragile.

Marcos Carias is a Coface economist for the North America region. He has a PhD in Economics from the University of Bordeaux in France, and provides frequent country risk monitoring and macroeconomic forecasts for the U.S., Canada and Mexico. For more economic insights, follow Marcos on LinkedIn.

Interested in business protection and predictive insights? Contact our experts now.